SSS Pension Calculator

What Is SSS?

The Social Security System (SSS) is a government-run program in the Philippines that provides social protection to workers in the private, informal, and self-employed sectors. It offers various benefits like sickness, maternity, disability, and of course—retirement pension. To help members estimate their future retirement income, the SSS Pension Calculator is a valuable tool that makes planning for retirement easier and more accurate.

Why Does It Matter for Filipinos?

Because retirement doesn’t come with a warning bell. For millions of hardworking Filipinos, SSS serves as the safety net after decades of service. Whether you’re a 9-to-5 employee or a tricycle driver making voluntary contributions, your pension will be your monthly cushion in your senior years.

What Is the SSS Pension Calculator?

Overview of the SSS Pension Calculator Tool

The SSS Pension Calculator is a simple but powerful online tool found at ssscontributioncalculator.com. It helps members estimate how much pension they might receive upon retirement—without the need for complex math or spreadsheets.

Who Should Use It?

Anyone who:

- Is currently contributing to SSS

- Plans to retire and wants to plan ahead

- Is unsure if their current contributions are enough

How It Works

You input basic information like salary, years of contribution, and desired retirement age. The calculator then estimates your future monthly pension based on current formulas used by the SSS.

How to Access the SSS Pension Calculator

The site is user-friendly, ad-free, and accessible on both desktop and mobile devices.

Mobile Accessibility and Usability

No app needed! Just head to the site from your smartphone browser, and you’re good to go.

Step-by-Step Guide to Using the SSS Pension Calculator

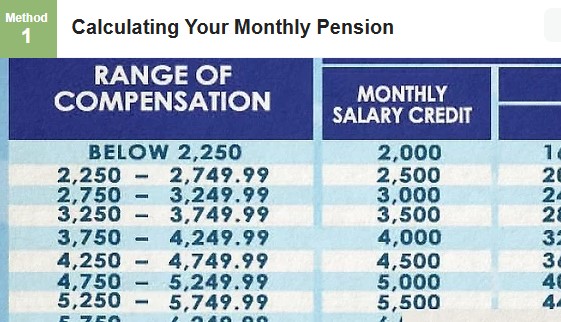

Step 1: Entering Monthly Salary

Start by typing in your average monthly salary. This will determine your Monthly Salary Credit (MSC), a key factor in pension computation.

Step 2: Selecting Years of Contribution

Next, select how many years you’ve contributed or plan to contribute. The more years, the higher your pension.

Step 3: Choosing Retirement Age

You can retire as early as 60 or wait until 65 for maximum benefits. Choose wisely!

Step 4: Viewing Results

Once done, hit “Calculate” and instantly see:

- Estimated monthly pension

- Total contributions

- Possible lump-sum benefit

Understanding the Results

Monthly Pension Estimate

This shows your expected monthly income after retirement based on your input.

Lump-Sum Option

If you opt to withdraw everything at once, the calculator will estimate how much you’ll receive.

Comparison with Manual Calculation

Instead of scratching your head over formulas, this tool does the math for you—instantly and accurately.

How SSS Calculates Your Pension

The Three SSS Pension Formulas

- 300 + (20% of AMSC) + (2% of AMSC x CYS beyond 10 years)

- 40% of AMSC

- ₱1,200 to ₱2,400 (minimum pension range)

The highest result among the three is chosen.

Average Monthly Salary Credit (AMSC)

This is your average salary over your highest 60 months of contribution.

Credited Years of Service (CYS)

Each year you’ve paid into SSS is a credited year—more years = higher pension.

Maximizing Your SSS Pension

Tips to Increase Monthly Pension

- Contribute consistently and longer

- Aim for higher salary brackets

- Delay retirement if possible

When Should You Start Contributing?

The earlier, the better. Even small contributions early in your career can grow substantially over time.

How Voluntary Contributions Help

If you’re a freelancer or OFW, making voluntary payments can ensure you’re eligible for pension later on.

Common Mistakes When Using the Calculator

Incorrect Income Input

Double-check your real salary and contribution level. Wrong input = wrong estimate.

Ignoring Voluntary Contributions

If you’ve made voluntary payments, include them in your CYS to get a more accurate figure.

Assuming Results Are Final

Remember, the calculator gives estimates only. The actual pension will be determined by SSS’s records.

Who Can Benefit the Most from the Calculator?

OFWs

They often miss out on contributions—this tool shows how voluntary payments affect retirement.

Freelancers and Self-Employed

Helps non-traditional workers plan better for the future.

Private Employees

If you’ve been working for years, this tool tells you what to expect when you finally hang your ID badge.

Limitations of the SSS Pension Calculator

Not Linked to Official SSS Records

It doesn’t access your actual SSS account—only the official My.SSS portal can do that.

Estimates May Change

Laws and contribution brackets change, which could affect your pension in the future.

For Informational Purposes Only

Think of it as a financial GPS, not the final destination.

Final Thoughts and Recommendations

Using the SSS Pension Calculator is one of the smartest financial planning tools available for Filipinos today. It takes out the guesswork, helps you make better life decisions, and empowers you to take control of your future. Start using it now—because planning for retirement shouldn’t wait until you’re already there.

Conclusion

Retirement doesn’t have to be a mystery. With the right tools, like the SSS Pension Calculator, you can map out a future that’s secure, sustainable, and satisfying. Whether you’re just starting your career or nearing the finish line, knowing what to expect financially can bring priceless peace of mind.

FAQs

1. Is the SSS Pension Calculator free to use?

Yes, it’s 100% free and accessible to everyone.

2. Can I use it on my phone?

Absolutely! It’s mobile-optimized and easy to use.

3. Does it show exact SSS pension amounts?

No, it provides estimates only. Final figures depend on SSS’s official records.

4. What if I stop contributing temporarily?

The calculator won’t reflect breaks in your contributions, but SSS will consider them during final computation.

5. Can I use the calculator if I’m not yet an SSS member?

Yes! It can help you decide whether or not to start contributing.

You’ll also love :